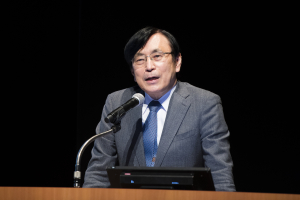

Assessing the Integrated Reform of Tax and Social Security Systems in Japan 2(-2025)

The Kishida administration declared in June 2023 its readiness to take “extraordinary measures” over the next several years to stem the declining birthrate in response to the shocking report that births in Japan fell below 800,000 for the first time in 2022. The decline in the birthrate, coupled with population aging, raises serious doubts about the sustainability of the social security system, fuels public anxiety about the future, and will have a negative impact on economic growth.

This research program will examine the impact Kishida’s announcement is likely to have as concrete measures are proposed and implemented.

The biggest challenge the initiative faces is the issue of financial resources. Thought is being given to adjusting expenditures and raising social insurance payments, particularly for health insurance, but a stable, permanent revenue source is needed. To this end, it is necessary to find the best mix, which may require reforms to the consumption tax, income tax, asset tax, and other taxes. To gain the public’s understanding, there is also a need to present a clear picture of the benefits and burdens. The research program will invite experts to explore how such a best mix of benefits and burdens can be achieved.

RECENT CONTENT

-

Will Regional Revitalization Really Increase the Birth Rate?

Will Regional Revitalization Really Increase the Birth Rate?

-

Three Points of Note Concerning the Latest Health Expenditure Figures: Accurately and Promptly Compiling Government Statistics

Three Points of Note Concerning the Latest Health Expenditure Figures: Accurately and Promptly Compiling Government Statistics

-

The Truth of the Annual Income Barrier and Current Pension System Distortions

The Truth of the Annual Income Barrier and Current Pension System Distortions

-

Funding the Policies to Boost Japan’s Birthrate

Funding the Policies to Boost Japan’s Birthrate

![[Policy Research] Water Minfra: A New Strategy for Water-Centric Social Infrastructure](/files_thumbnail/research_2023_Oki_PG_Mizuminhura_png_w300px_h180px.png)